Page 40 - Q&A 2019/2020

P. 40

Tax incentives for employing youth in your

business

Danie Krige

April 2019

“I have a young business that is developing well. But I need to appoint more

staff. I’ve heard that there are tax incentives for employing youth. How do these

work?”

A useful tax incentive for employing youth is ETI or Employee Tax Incentive. Commercial

ETI allows you to benefit up to R12,000 per year for every qualifying youth you

employ. ETI was introduced to help make it more affordable for businesses to

appoint new staff and assist young job seekers to find employment.

Through ETI, SARS subsidizes the appointment of youth by allowing a business

to decrease their Pay-As-You-Earn (PAYE) for every qualifying youth that is hired.

Businesses can decrease PAYE for up to 24 months from date of appointment.

There is also no restriction on the number of employees that you claim ETI for.

Employees who qualify for ETI must meet the following requirements:

• Possess a South African ID

• Be between 18 – 29 years of age

• May not be domestic workers

• May not be related or connected to the employer

• Must earn at least a minimum wage

• May not earn more than R6000 per month.

• Must be a new appointment with the employer.

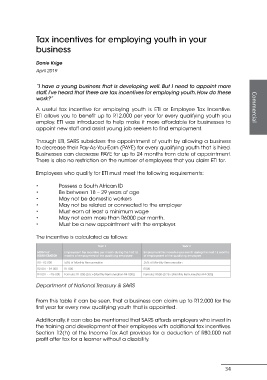

The incentive is calculated as follows:

Year 1 Year 2

MONTHLY Employment Tax Incentive per month during the first 12 Employment Tax Incentive per month during the next 12 months

REMUNERATION months of employment of the qualifying employee of employment of the qualifying employee

R0 - R2 000 50% of Monthly Remuneration 25% of Monthly Remuneration

R2 001 - R4 000 R1 000 R500

R4 001 - <R6 000 Formula: R1 000-(0.5 x (Monthly Remuneration-R4 000)) Formula: R500-(0.25 x (Monthly Remuneration-R4 000))

Department of National Treasury & SARS

From this table it can be seen, that a business can claim up to R12,000 for the

first year for every new qualifying youth that is appointed.

Additionally, it can also be mentioned that SARS affords employers who invest in

the training and development of their employees with additional tax incentives.

Section 12(h) of the Income Tax Act provides for a deduction of R80,000 net

profit after tax for a learner without a disability.

34